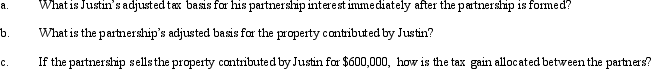

Greg and Justin are forming the GJ Partnership.Greg contributes $500,000 cash and Justin contributes nondepreciable property with an adjusted basis of $200,000 and a fair market value of $550,000.The property is subject to a $50,000 liability, which is also transferred into the partnership and is shared equally by the partners for basis purposes.Greg and Justin share in all partnership profits equally except for any precontribution gain, which must be allocated according to the statutory rules for built-in gain allocations.

Definitions:

Monocular Depth Cues

Depth cues that can be perceived by one eye alone.

Retinal Disparity

The slight difference in images between the two eyes due to their different positions, enabling depth perception.

Depth Perception

Refers to the ability to perceive the world in three dimensions (3D) and to understand the distance of objects from oneself and each other.

Shape Continuity

A principle of perceptual organization that explains how humans tend to perceive a series of points or lines as having unity, forming a continuous shape.

Q1: Binita contributed property with a basis of

Q23: Section 351 (which permits transfers to controlled

Q72: Most IRAs can own stock in an

Q80: The carryover period for the NOLs of

Q97: Corporate shareholders generally receive less favorable tax

Q101: The amount of a partnership's income and

Q103: If an exempt organization owns a feeder

Q103: During the current year, Kingbird Corporation (a

Q108: If a C corporation uses straight-line depreciation

Q125: Identify the components of the tax model