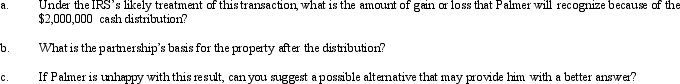

Palmer contributes property with a fair market value of $4,000,000 and an adjusted basis of $3,000,000 to AP Partnership.Palmer shares in $1,000,000 of partnership debt under the liability sharing rules, giving him an initial adjusted basis for his partnership interest of $4,000,000.One month after the contribution, Palmer receives a cash distribution from the partnership of $2,000,000.Palmer would not have contributed the property if the partnership had not contractually obligated itself to make the distribution.Assume Palmer's share of partnership liabilities will not change as a result of this distribution.

Definitions:

Selling Expenses

Costs incurred directly and indirectly in making sales, including advertising, commissions, and shipping expenses.

Operating Expenses

Ongoing costs for running a business that do not include the cost of goods sold but can cover expenses such as rent, utilities, and salaries.

Accounts Payable

Accounts payable is the amount a company owes to its suppliers or creditors for goods or services received but not yet paid for.

Q8: A realized gain from an involuntary conversion

Q14: Distributions that are not dividends are a

Q34: The Dispensary is a pharmacy that is

Q37: Aaron owns a 30% interest in a

Q41: Dick, a cash basis taxpayer, incorporates his

Q45: Carl transfers land to Cardinal Corporation for

Q48: Similar to like-kind exchanges, the receipt of

Q73: Which of the following is not an

Q83: If an organization qualifies for exempt status

Q140: The gross estate of John, decedent, includes