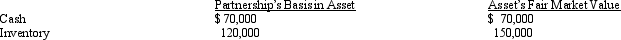

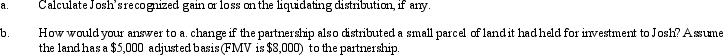

Josh has a 25% capital and profits interest in the calendar-year GDJ Partnership.His adjusted basis for his partnership interest on October 15 of the current year is $300,000.On that date, the partnership liquidates and makes a proportionate distribution of the following assets to Josh.

Definitions:

Actual Performance

The real, observed output, results, or accomplishments of a process, individual, or organization, often compared against planned or expected performance.

Predetermined Level

A set benchmark or standard established in advance to guide production activities or cost estimations.

Cost Variance

The difference between the expected (budgeted) cost of an activity and its actual cost.

Standard Cost

A predetermined cost serving as a benchmark for evaluating the actual cost performance of activities.

Q7: In structuring the capitalization of a corporation,

Q14: Distributions that are not dividends are a

Q25: The treatment of corporate reorganizations is similar

Q31: If a stock dividend is taxable, the

Q32: One of the disadvantages of the partnership

Q49: On December 20, 2012, the directors of

Q52: Yoko purchased 10% of Toyger Corporation's stock

Q63: Which of the following are qualified corporate

Q88: Amy owns 20% of the stock of

Q121: If the partnership properly makes an election