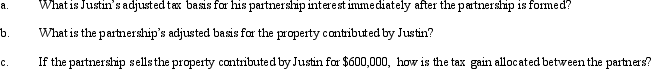

Greg and Justin are forming the GJ Partnership.Greg contributes $500,000 cash and Justin contributes nondepreciable property with an adjusted basis of $200,000 and a fair market value of $550,000.The property is subject to a $50,000 liability, which is also transferred into the partnership and is shared equally by the partners for basis purposes.Greg and Justin share in all partnership profits equally except for any precontribution gain, which must be allocated according to the statutory rules for built-in gain allocations.

Definitions:

Commencement Of Production

The point at which a company begins manufacturing products or producing goods in a new or existing facility.

Total Costs Of Ownership

The comprehensive assessment of all costs associated with the purchase, operation, and maintenance of a good or service over its life cycle.

Suppliers

Companies or individuals that provide goods or services to another entity as part of a supply chain.

Time-Based Management

A strategic approach that focuses on reducing the time required to conduct various business processes to improve performance and competitiveness.

Q15: Pursuant to a complete liquidation, Oriole Corporation

Q26: The § 1374 tax is a corporate-level

Q43: Noncorporate shareholders may elect out of §

Q57: When computing current E & P, taxable

Q61: Purple Corporation has accumulated E & P

Q82: Michelle receives a proportionate liquidating distribution when

Q84: Timothy owns 100% of Forsythia Corporation's stock.Corporate

Q88: Midge is the chairman of the board

Q137: Discuss the two methods of allocating tax-related

Q141: The taxable income of a partnership flows