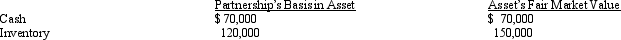

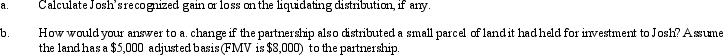

Josh has a 25% capital and profits interest in the calendar-year GDJ Partnership.His adjusted basis for his partnership interest on October 15 of the current year is $300,000.On that date, the partnership liquidates and makes a proportionate distribution of the following assets to Josh.

Definitions:

Intuition

The ability to understand or know something immediately, without the need for conscious reasoning.

Creativity and innovation

The process of generating new and original ideas that can be transformed into valuable products, services, or methodologies.

Acts of terrorism

Violent acts intended to create fear, perpetrated for a religious, political, or ideological goal, often targeting civilians.

Crisis decisions

Decision-making processes undertaken during times of crisis or emergency, often under conditions of uncertainty and high stress.

Q19: S corporation status allows shareholders to realize

Q24: Rust Corporation distributes property to its sole

Q32: You are completing the State A income

Q35: Which of the following are consequences of

Q69: If both §§ 357(b) and (c) apply

Q97: Martha receives a proportionate nonliquidating distribution when

Q106: On a partnership's Form 1065, which of

Q111: Kim Corporation, a calendar year taxpayer, has

Q115: Finch Corporation (E & P of $400,000)

Q158: Which of the following is not a