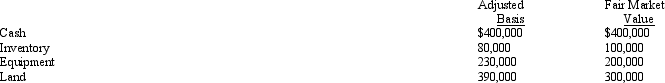

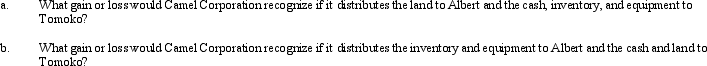

The stock in Camel Corporation is owned by Albert and Tomoko, who are unrelated.Albert owns 30% and Tomoko owns 70% of the stock in Camel Corporation. All of Camel Corporation's assets were acquired by purchase.The following assets are to be distributed in complete liquidation of Camel Corporation:

Definitions:

Abdominal Musculature

The muscles located in the abdomen, including the rectus abdominis, obliques, and transversus abdominis, crucial for posture and movement.

Abdominal Tone

The condition of the abdominal muscles regarding their tightness or firmness, often assessed during physical examination.

Hernia

A medical condition where an organ or fatty tissue squeezes through a weak spot in the surrounding muscle or connective tissue.

Abdominal Muscles

A group of muscles located in the abdomen that supports the trunk, allows movement and holds organs in place by regulating internal abdominal pressure.

Q6: For transfers falling under § 351, what

Q6: Discuss the purpose of Schedule M-1.Give two

Q25: A taxpayer must pay any tax deficiency

Q27: The stock in Tangerine Corporation is held

Q53: An S corporation with substantial AEP has

Q63: Tina incorporates her sole proprietorship with assets

Q104: Mack has a basis in a partnership

Q109: The alternative minimum tax applies to an

Q121: If the partnership properly makes an election

Q123: Which, if any, of the following items