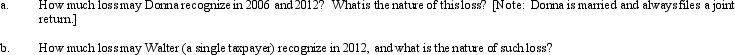

In 2005, Donna transferred assets (basis of $300,000 and fair market value of $250,000) to Egret Corporation in return for 200 shares of § 1244 stock. Due to § 351, the transfer was nontaxable; therefore, Donna's basis in the Egret stock is $300,000. In 2006, Donna sells 100 of these shares to Walter (a family friend) for $100,000. In 2012, Egret Corporation files for bankruptcy, and its stock becomes worthless.

Definitions:

Factory Overhead

The indirect costs associated with manufacturing, including indirect labor, indirect materials, and other expenses that cannot be directly tied to the production of goods.

Indirect Material

Items used in the production process that do not become a part of the final product, such as lubricants for machines.

Direct Materials

Raw materials that are directly traceable to the production of a specific product and are a significant component of manufacturing expenses.

Nonmanufacturing Cost

Expenses that are not directly associated with the production of goods, including selling, general, and administrative expenses.

Q3: Tom and George form Swan Corporation with

Q28: On June 10, 2012, Ebon, Inc.acquired an

Q30: The corporate marginal income tax rates range

Q41: A business machine purchased April 10, 2010,

Q50: A tax preference can increase or decrease

Q51: Camelia Company is a large commercial real

Q59: Are the AMT rates for the individual

Q65: A U.S.District Court is the lowest trial

Q111: In 2012, Amber had a $100,000 loss

Q132: Rental use depreciable machinery held more than