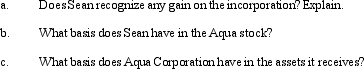

Sean, a sole proprietor, is engaged in a service business and uses the cash basis of accounting.In the current year, Sean incorporates his business by forming Aqua Corporation.In exchange for all of its stock, Aqua receives: assets (basis of $400,000 and fair market value of $2 million), trade accounts payable of $110,000, and loan due to a bank of $390,000.The proceeds from the bank loan were used by Sean to provide operating funds for the business.Aqua Corporation assumes all of the liabilities transferred to it.

Definitions:

Profits

Profits represent the financial benefit that is realized when the amount of revenue gained from a business activity exceeds the expenses, costs, and taxes involved in sustaining the activity.

Penalty

A penalty applied for violating a regulation, agreement, or statute.

Financial Statements

Financial statements are formal records of the financial activities and position of a business, person, or other entity, providing an overview of a financial situation over a specified period.

Independent Public Accountant

A licensed professional who performs audits and provides financial analysis and advice without being affiliated with the audited entity.

Q10: Prior to the effect of tax credits,

Q26: Which items tell taxpayers the IRS's reaction

Q31: The use of § 351 is not

Q42: Which one of the following is not

Q57: Barry and Irv form Rapid Corporation. Barry

Q66: Gold Corporation, Silver Corporation, and Platinum Corporation

Q73: For § 351 purposes, stock rights and

Q103: After personal property is fully depreciated for

Q115: Involuntary conversion gains may be deferred if

Q123: In a proportionate liquidating distribution, Sara receives