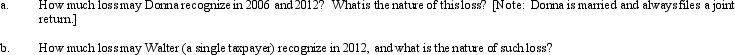

In 2005, Donna transferred assets (basis of $300,000 and fair market value of $250,000) to Egret Corporation in return for 200 shares of § 1244 stock. Due to § 351, the transfer was nontaxable; therefore, Donna's basis in the Egret stock is $300,000. In 2006, Donna sells 100 of these shares to Walter (a family friend) for $100,000. In 2012, Egret Corporation files for bankruptcy, and its stock becomes worthless.

Definitions:

Q1: Linda formed Pink Corporation with an investment

Q60: Elbert gives stock worth $28,000 (no gift

Q65: In a not essentially equivalent redemption [§

Q77: If a distribution of stock rights is

Q84: Timothy owns 100% of Forsythia Corporation's stock.Corporate

Q85: Five years ago, Eleanor transferred property she

Q85: Katherine, the sole shareholder of Purple Corporation,

Q97: Kerri, who had AGI of $120,000, itemized

Q102: Since the Code section that defines "capital

Q111: In 2012, Amber had a $100,000 loss