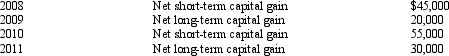

Bear Corporation has a net short-term capital gain of $35,000 and a net long-term capital loss of $200,000 during 2012.Bear Corporation has taxable income from other sources of $600,000.Prior years' transactions included the following:  Compute the amount of Bear's capital loss carryover to 2013.

Compute the amount of Bear's capital loss carryover to 2013.

Definitions:

Call Contract

A financial contract that gives the buyer the right, but not the obligation, to buy a specified amount of an asset at a predetermined price within a specified time period.

Write

In finance, to sell an option contract, effectively creating a new option in the market.

Call Option

A financial contract that gives the buyer the right, but not the obligation, to buy an asset at a specified price within a specified period.

Premium

The amount paid for an option or insurance policy over its intrinsic value or the amount by which the price of a bond exceeds its face value.

Q4: Rita forms Finch Corporation by transferring land

Q13: Kathy was a shareholder in Matrix, Inc.,

Q26: Puffin Corporation makes a property distribution to

Q37: Aaron owns a 30% interest in a

Q41: Samuel's hotel is condemned by the City

Q54: Bianca and Barney have the following for

Q63: Eagle Corporation owns stock in Hawk Corporation

Q114: Identify an AMT adjustment that applies for

Q120: How can interest on a private activity

Q136: As of January 1, Cassowary Corporation has