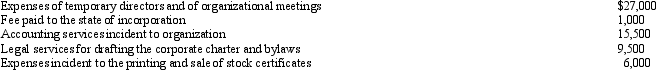

Emerald Corporation, a calendar year C corporation, was formed and began operations on April 1, 2012. The following expenses were incurred during the first tax year (April 1 through December 31, 2012) of operations:  Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2012?

Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2012?

Definitions:

Bearer

An individual in possession of an instrument, such as a check or bond, that is not made out to a specific payee.

Certified Cheque

A cheque guaranteed by a bank, indicating that the funds are available and have been set aside for the payee.

Bill Drawn

A document requesting the payment of money, typically used in international trade, specifying the amount and terms of payment.

Drawee

is the party, often a bank, required to pay the monetary amount specified in a check or draft.

Q5: Mike is a self-employed TV technician.He is

Q7: When searching on an online tax service,

Q8: An individual has the following recognized gains

Q23: Section 351 (which permits transfers to controlled

Q24: If a gambling loss itemized deduction is

Q47: Lucinda owns 1,100 shares of Blackbird Corporation

Q59: Laura purchased for $1,610 a $2,000 bond

Q75: Steve has a capital loss carryover in

Q87: Grackle Corporation (E & P of $600,000)

Q131: Which of the following statements is correct?<br>A)When