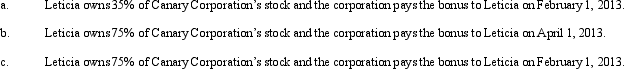

Canary Corporation, an accrual method C corporation, uses the calendar year for tax purposes. Leticia, a cash method taxpayer, is both a shareholder of Canary and the corporation's CFO. On December 31, 2012, Canary has accrued a $75,000 bonus to Leticia. Describe the tax consequences of the bonus to Canary and to Leticia under the following independent situations.

Definitions:

Biopsychosocial Approach

A holistic perspective in healthcare and psychology that integrates biological, psychological, and social factors in understanding and treating illness.

Integrated Explanation

A comprehensive understanding that combines elements from various sources or theories to provide a complete account of a phenomenon.

Mental Processes

Internal, covert activities of the mind such as thinking, reasoning, and remembering.

Cultural

Pertaining to the customs, beliefs, arts, and collective identity and behavior of a society or community.

Q4: A personal use property casualty loss is

Q21: Vicki owns and operates a news agency

Q26: The amount of gain recognized by a

Q66: A shareholder's holding period for stock received

Q71: What incentives do the tax accounting rules

Q73: Tern Corporation, a cash basis taxpayer, has

Q74: Which one of the following statements is

Q79: Jamison owned a rental building (but not

Q79: Which company does not publish citators for

Q134: Lupe and Rodrigo, father and son, each