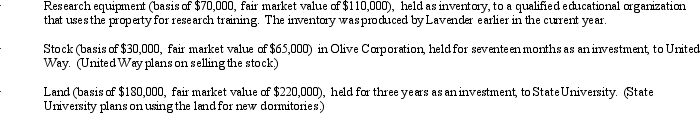

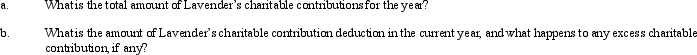

During the current year, Lavender Corporation, a C corporation in the business of manufacturing tangible research equipment, made charitable contributions to qualified organizations as follows:

Lavender Corporation's taxable income (before any charitable contribution deduction) is $2.5 million.

Lavender Corporation's taxable income (before any charitable contribution deduction) is $2.5 million.

Definitions:

State Supreme Court

The highest court in a U.S. state, responsible for interpreting state laws and constitutions.

U.S. Supreme Court

The highest federal court in the United States, consisting of nine justices and having ultimate appellate jurisdiction over all federal and state court cases involving issues of federal law.

Japanese Trial System

The judicial process in Japan, which includes a combination of civil law principles and unique national procedures for adjudicating legal disputes.

Discovery Process

The discovery process is a pre-trial procedure in a lawsuit where each party can obtain evidence from the other parties through methods like requests for answers, documents, and depositions.

Q1: A corporation with $5 million or more

Q8: An individual has the following recognized gains

Q19: Cocoa Corporation is acquiring Milk Corporation in

Q22: When depreciable property is transferred to a

Q38: Discuss the application of holding period rules

Q49: Issues relating to basis arise when a

Q69: During the current year, Owl Corporation (a

Q69: Lynne owns depreciable residential rental real estate

Q80: Martha has both long-term and short-term 2011

Q117: Section 1239 (relating to the sale of