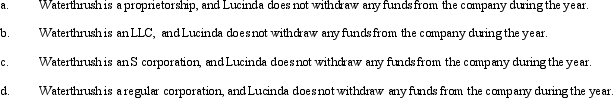

During the current year, Waterthrush Company had operating income of $510,000 and operating expenses of $400,000. In addition, Waterthrush had a long-term capital gain of $30,000. How does Lucinda, the sole owner of Waterthrush Company, report this information on her individual income tax return under following assumptions?

Definitions:

Q24: Define an involuntary conversion.

Q37: In 2011, Jenny had a $12,000 net

Q40: Platinum Corporation, a calendar year taxpayer, has

Q42: Related-party installment sales include all of the

Q44: Magenta Corporation acquired land in a §

Q48: Similar to like-kind exchanges, the receipt of

Q61: In a § 351 transaction, Gerald transfers

Q70: On April 7, 2011, Crow Corporation acquired

Q105: If the AMT base is greater than

Q119: A business taxpayer trades in a used