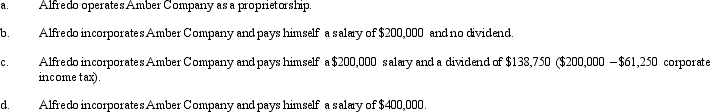

Amber Company has $400,000 in net income in 2012 before deducting any compensation or other payment to its sole owner, Alfredo. Assume that Alfredo is in the 35% marginal tax bracket. Discuss the tax aspects of each of the following independent arrangements. (Assume that any salaries are reasonable in amount and ignore any employment tax considerations.)

Definitions:

Shift Loyalties

The act of changing alliance or fidelity from one association, brand, or cause to another, often influenced by new information or changes in circumstances.

Socialization Practices

The processes through which individuals learn and adopt the norms, values, behaviors, and social skills appropriate to their society or culture.

Continuance Commitment

The extent to which employees feel committed to their organization based on the costs they perceive in leaving it.

High Levels

Refers to a greater degree or intensity in a specific context, such as high levels of productivity, stress, or engagement in the workplace.

Q5: Which publisher offers the Standard Federal Tax

Q9: Monica sells a parcel of land to

Q16: Because services are not considered property under

Q21: Property sold to a related party purchaser

Q24: Three judges will normally hear each U.S.Tax

Q58: In 1916, the Supreme Court decided that

Q69: What statement is not true with respect

Q70: Pedro, not a dealer, sold real property

Q81: In a U.S.District Court, a jury can

Q85: Theresa and Oliver, married filing jointly, and