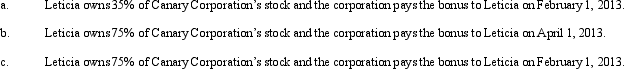

Canary Corporation, an accrual method C corporation, uses the calendar year for tax purposes. Leticia, a cash method taxpayer, is both a shareholder of Canary and the corporation's CFO. On December 31, 2012, Canary has accrued a $75,000 bonus to Leticia. Describe the tax consequences of the bonus to Canary and to Leticia under the following independent situations.

Definitions:

Percentile

A measure indicating the value below which a given percentage of observations in a group of observations fall.

Quartile

A statistical term describing each of four equal groups into which a population can be divided based on a distribution.

Histogram

A graphical representation of the distribution of numerical data, showing the frequency of data points in consecutive, non-overlapping intervals.

Q20: What kinds of property do not qualify

Q21: Albert is in the 35% marginal tax

Q29: Dividends paid to shareholders who hold both

Q65: After 5 years of marriage, Dave and

Q77: Tariq sold certain U.S.Government bonds and State

Q78: Federal tax legislation generally originates in the

Q78: Harold is a head of household, has

Q90: For each of the following involuntary conversions,

Q113: The required adjustment for AMT purposes for

Q122: Ryan has the following capital gains and