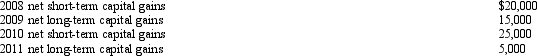

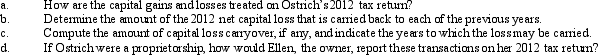

Ostrich, a C corporation, has a net short-term capital gain of $20,000 and a net long-term capital loss of $90,000 during 2012.Ostrich also has taxable income from other sources of $1 million.Prior years' transactions included the following:

Definitions:

Medically-Oriented

A focus or approach centered on medical principles and practices.

Medical Models

The frameworks or theories that describe how diseases develop and should be treated, varying from the biomedical model focusing on biological factors to more holistic approaches considering social factors.

Diagnosis Specific

Pertaining to the identification of a particular health condition based on its unique symptoms, signs, and test results.

Care Coordination

The deliberate organization of patient care activities and sharing information among all participants concerned with a patient's care to achieve safer and more effective care.

Q20: A taxpayer must pay any tax deficiency

Q24: Define an involuntary conversion.

Q26: Which items tell taxpayers the IRS's reaction

Q34: Technical Advice Memoranda may not be cited

Q47: When forming a corporation, a transferor-shareholder may

Q61: During the current year, Thrasher, Inc., a

Q65: Omar acquires used 7-year personal property for

Q72: Even if boot is generated under §

Q110: Nell has a personal casualty loss deduction

Q129: Allison and Taylor form a partnership by