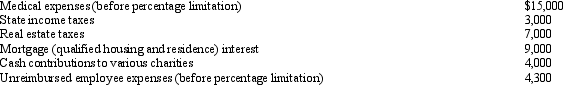

Mitch, who is single and has no dependents, had AGI of $100,000 in 2012.His potential itemized deductions were as follows:  What is the amount of Mitch's AMT adjustment for itemized deductions for 2012?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2012?

Definitions:

Execute Acts

To carry out, implement, or perform actions or laws as prescribed by a legal or authoritative body.

Nation's Interests

The economic, cultural, and political goals that a country considers important or necessary for its survival and growth.

Constitutional Power

The authority granted to the branches of government by a constitution, outlining the scope and limits of government actions.

Declare War

To declare war is a formal act by which one nation goes to war against another, typically involving a declaration by a country's legislative or executive authority.

Q23: Which of the following creates potential §

Q29: Compare the taxation of C corporations with

Q43: A doctor's incorporated medical practice may end

Q70: The Code contains two major depreciation recapture

Q107: Grebe Corporation, a closely held corporation that

Q121: Sylvia owns 25% of Cormorant Corporation.Cormorant sells

Q124: Robin Corporation has ordinary income from operations

Q135: Which of the following would not be

Q166: Emma gives 1,000 shares of Green, Inc.stock

Q177: Pierce exchanges an asset (adjusted basis of