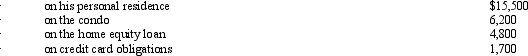

Ted, who is single, owns a personal residence in the city.He also owns a condo near the ocean.He uses the condo as a vacation home.In March 2012, he borrowed $50,000 on a home equity loan and used the proceeds to acquire a luxury automobile.During 2012, he paid the following amounts of interest:  What amount, if any, must Ted recognize as an AMT adjustment in 2012?

What amount, if any, must Ted recognize as an AMT adjustment in 2012?

Definitions:

Talent Development

The process of identifying, nurturing, and helping individuals improve their skills and abilities to meet current and future organizational needs.

Financial Resources

Monetary assets and funds available to an individual, organization, or country for use in achieving goals or covering expenses.

MOOCs

Massive Open Online Courses are online courses aimed at unlimited participation and open access via the web, providing an affordable and flexible way to learn new skills and advance educational qualifications.

Corporate Learners

Employees engaged in ongoing learning and development provided by their organizations.

Q7: A realized gain on the sale or

Q12: Explain the stock attribution rules that apply

Q29: If a taxpayer deducts the standard deduction

Q58: Which of the following statements is correct

Q71: Melissa, age 58, marries Arnold, age 50,

Q82: On January 2, 2012, Orange Corporation purchased

Q89: Five years ago, Joe, a single taxpayer,

Q106: Milt's building which houses his retail sporting

Q120: How can interest on a private activity

Q126: Expenditures made for ordinary repairs and maintenance