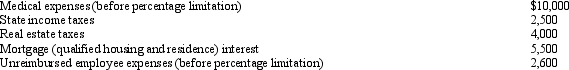

Cindy, who is single and has no dependents, has adjusted gross income of $50,000 in 2012.Her potential itemized deductions are as follows:

What is the amount of Cindy's AMT adjustment for itemized deductions for 2012?

What is the amount of Cindy's AMT adjustment for itemized deductions for 2012?

Definitions:

Establish Relationships

The process of creating connections or bonds with others, which can be based on emotions, professional ties, or mutual interests.

Men

Refers to adult human males.

Repetition

The action of repeating something that has already been said or written, often used as a method of learning or reinforcing knowledge.

Personal Communication

The exchange of information, feelings, and meaning through verbal and non-verbal messages on an individual or personal level.

Q22: The adjusted basis of property that is

Q27: How does the definition of accumulated E

Q33: Which of the following exchanges qualifies for

Q41: Dick, a cash basis taxpayer, incorporates his

Q51: Cindy, who is single and has no

Q53: Heron Corporation, a calendar year, accrual basis

Q68: At a time when Blackbird Corporation had

Q80: Sammy exchanges equipment used in his business

Q107: BlueCo incurs $700,000 during the year to

Q112: Which of the following statements is correct?<br>A)The