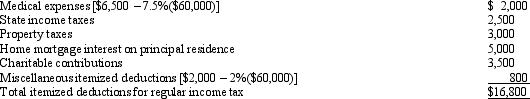

In calculating her taxable income, Rhonda deducts the following itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

Definitions:

Customer Satisfaction

The measure of how products or services provided by a company meet or surpass customer expectation.

Traditional Measurement

A method of evaluating performance or progress using long-established standards or units.

Return On Investment

A measure used to evaluate the performance of an investment by dividing the net profit by the initial cost of the investment.

Cost Variance

The difference between the estimated cost of a project or operation and the actual cost incurred.

Q38: During the current year, Shrike Company had

Q50: Robin Construction Company began a long-term contract

Q53: The AMT can be calculated using either

Q66: Larry was the holder of a patent

Q71: In September, Dorothy purchases a building for

Q77: If a distribution of stock rights is

Q93: Earl and Mary form Crow Corporation.Earl transfers

Q101: Julia's tentative AMT is $94,000. Her regular

Q107: As a result of a redemption, a

Q121: What is the relationship between taxable income