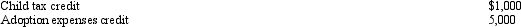

Prior to the effect of the tax credits, Justin's regular income tax liability is $200,000 and his tentative AMT is $195,000.Justin has the following credits:  Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.

Definitions:

Events

Occurrences or happenings, especially those of significance, that can be observed or participated in.

Accurately Describe

To represent or convey something in a manner that is precise, correct, and free from error or distortion.

Group Assessment

The process of evaluating the abilities, performances, or needs of a group of individuals rather than individuals separately.

Resource Intensive

Describes processes or activities that require a large amount of resources, such as time, money, or manpower, to be executed effectively.

Q16: Section 1250 depreciation recapture will apply when

Q22: The only things that the grantee of

Q24: If a gambling loss itemized deduction is

Q50: George Judson is the sole shareholder and

Q55: Vertical, Inc., has a 2012 net §

Q69: Explain the requirements for waiving the family

Q77: Tariq sold certain U.S.Government bonds and State

Q83: Gold Corporation, Silver Corporation, and Copper Corporation

Q85: Theresa and Oliver, married filing jointly, and

Q99: The sale of business property might result