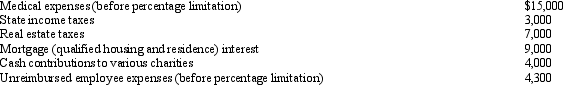

Mitch, who is single and has no dependents, had AGI of $100,000 in 2012.His potential itemized deductions were as follows:  What is the amount of Mitch's AMT adjustment for itemized deductions for 2012?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2012?

Definitions:

Relevant Cost

A relevant cost is a cost that will be affected by a decision in the future and is important in business decision-making processes.

Depreciation Charge

An accounting expense recorded to allocate the cost of a tangible asset over its useful life.

Book Value

The value of an asset according to its balance sheet account balance, often different from its market value.

Q2: Schedule M-1 of Form 1120 is used

Q14: A calendar year C corporation with average

Q16: Realized losses from the sale or exchange

Q62: Three individuals form Skylark Corporation with the

Q69: Factors that can cause the adjusted basis

Q72: In the current year, Oriole Corporation donated

Q76: What effect do deductible gambling losses for

Q104: Sand, Inc., has AMTI of $200,000. Calculate

Q159: Since wash sales do not apply to

Q170: Which of the following statements is correct?<br>A)In