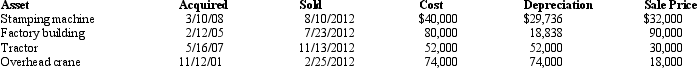

The chart below describes the § 1231 assets sold by the Ecru Company (a sole proprietorship) this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year.Assume there is a § 1231 lookback loss of $4,000.

Definitions:

Region

The context in which the performance takes place, including location, décor, and props.

Cover-Up

The act of concealing or hiding something often regarded as inconvenient, embarrassing, or incriminating from public view.

Acceptable

Considered satisfactory or permissible in a given context.

Agents of Socialization

Individuals, groups, and institutions that shape an individual's social development and cultural norms.

Q19: Peach Corporation had $210,000 of active income,

Q29: Which of the following statements regarding the

Q53: The AMT can be calculated using either

Q55: For regular income tax purposes, Yolanda, who

Q68: Agnes, a calendar year taxpayer, lists her

Q79: Last year, Ted invested $100,000 for a

Q82: Lucinda is a 60% shareholder in Rhea

Q93: A business taxpayer sells inventory for $40,000.The

Q95: Rick, a computer consultant, owns a separate

Q113: The surrender of depreciated boot (fair market