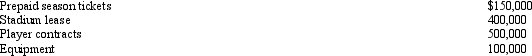

Marge purchases the Kentwood Krackers, a AAA level baseball team, for $1.5 million.The appraised values of the identified assets are as follows:

The Krackers have won the pennant for the past two years.Determine Marge's adjusted basis for the assets of the Kentwood Krackers.

The Krackers have won the pennant for the past two years.Determine Marge's adjusted basis for the assets of the Kentwood Krackers.

Definitions:

Fixed Costs

Costs that do not vary with the level of output, such as rent, salaries, and insurance premiums.

Cakes

Baked desserts typically made from ingredients like flour, sugar, and eggs.

Average Product

The output per unit of input, calculated by dividing total product by the number of units of input, used to measure productivity.

Construction Company

A construction company is a business entity that deals with the building, remodeling, maintenance, and demolition of structures, such as homes, offices, and other buildings, employing a range of skilled and unskilled laborers.

Q51: Original issue discount is amortized over the

Q51: Identify two tax planning techniques that can

Q57: Tad and Audria, who are married filing

Q57: Which of the following taxpayers is required

Q60: All of a taxpayer's tax credits relating

Q76: In regard to choosing a tax year

Q87: Miriam, who is a head of household

Q88: In 2012, Arnold invests $80,000 for a

Q92: Individuals who are not professional real estate

Q140: Abby exchanges 3,000 shares of Osprey, Inc.,