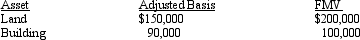

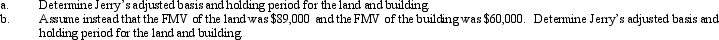

On September 18, 2012, Jerry received land and a building from Ted as a gift. Ted had purchased the land and building on March 5, 2009, and his adjusted basis and the fair market value at the date of the gift were as follows:

Ted paid gift tax on the transfer to Jerry of $96,000.

Ted paid gift tax on the transfer to Jerry of $96,000.

Definitions:

Legal Restrictions

Laws or regulations that limit or regulate certain actions or practices within a society or organization.

Field of Organizational Behaviour

An interdisciplinary field that studies how individuals, groups, and structure affect and are affected by behavior within organizations, aiming to improve organizational effectiveness and employee well-being.

Prediction

The act of forecasting or projecting the future outcome or trends based on current or past data, analysis, or trends.

Analysis

The process of breaking a complex topic or substance into smaller parts to gain a better understanding of it.

Q9: In determining the amount of the AMT

Q14: A calendar year C corporation with average

Q25: Golden Corporation is an eligible small business

Q46: The accrual basis taxpayer sold land for

Q49: In determining the basis of like-kind property

Q56: Mitchell owned an SUV that he had

Q74: Elvis owns all of the stock of

Q79: Robin, who is a head of household

Q125: When an individual taxpayer has a net

Q145: Khalid sells two personal use assets during