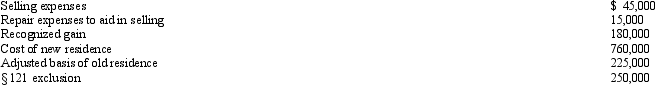

Use the following data to determine the sales price of Etta's principal residence and the realized gain.She is not married.The sale of the old residence qualifies for the § 121 exclusion.

Definitions:

Operating Activities

Business activities directly related to the production, sale, and delivery of a company's products or services, often reflected in the cash flow statement.

Prepaid Expenses

Costs paid for in advance of receiving the benefit of the service or product, recorded as an asset on the balance sheet until the expense is incurred.

Net Income

The total profit of a company after all expenses and taxes have been deducted from revenues.

Operating Activities

Activities directly related to the daily business operations, including cash generated from the core business as well as cash used.

Q3: The education tax credits (i.e., the American

Q9: Which of the following statements correctly reflects

Q10: During 2012, Barry (who is single and

Q17: The Seagull Partnership has three equal partners.Partner

Q27: a. Orange Corporation exchanges a warehouse located

Q68: Certain adjustments apply in calculating the corporate

Q72: Vanna owned an office building that had

Q83: Wes's at-risk amount in a passive activity

Q100: Certain high-income individuals are subject to three

Q127: A realized loss whose recognition is postponed