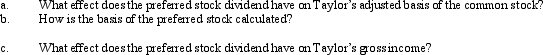

Taylor owns common stock in Taupe, Inc., with an adjusted basis of $100,000.She receives a preferred stock dividend which is nontaxable.

Definitions:

Paid-in Capital

The amount of money shareholders have invested in a company in exchange for equity, excluding any earnings retained by the company.

Market Value

The ongoing rate at which a commodity or service is offered for buying or selling in the market.

Dividend Yield

Dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price.

Cash Dividends

Payments made by a corporation to its shareholders in the form of cash out of its earnings.

Q10: Ahmad owns four activities. He participated for

Q23: During the current year, Quartz Corporation (a

Q25: In 2012 Angela, a single taxpayer with

Q30: Explain how the sale of investment property

Q48: Which of the following events could result

Q53: An employer's tax deduction for wages is

Q59: Which of the following satisfy the time

Q67: Discuss the relationship between the postponement of

Q139: Shari exchanges an office building in New

Q199: Section 1033 (nonrecognition of gain from an