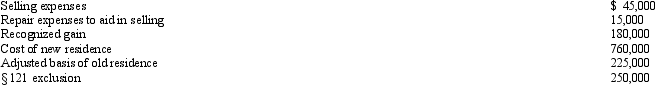

Use the following data to determine the sales price of Etta's principal residence and the realized gain.She is not married.The sale of the old residence qualifies for the § 121 exclusion.

Definitions:

Price of Bananas

refers to the market cost of bananas, which can vary based on factors like supply, demand, seasons, and geographical conditions.

Budget Line

A graph depicting all possible combinations of two goods that a consumer can afford given their income and the prices of the goods.

State Sales Taxes

Taxes imposed by state governments on the sale of goods and services within their jurisdiction.

Tax Policy

Guidelines and laws governing how taxes are structured, collected, and managed by a government to influence economic activity.

Q17: In 2012, Mark has $18,000 short-term capital

Q44: George and Martha are married and file

Q57: Which of the following taxpayers is required

Q83: Gold Corporation, Silver Corporation, and Copper Corporation

Q95: For individual taxpayers, the AMT credit is

Q95: Robin Corporation, a calendar year C corporation,

Q106: Phil and Audrey, husband and wife, are

Q163: During 2012, Howard and Mabel, a married

Q171: The holding period of property acquired by

Q183: The basis of property received by gift