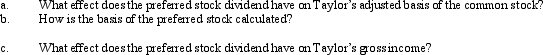

Taylor owns common stock in Taupe, Inc., with an adjusted basis of $100,000.She receives a preferred stock dividend which is nontaxable.

Definitions:

Competition

A situation in which individuals or groups are in a contest or rivalry to achieve a goal that cannot be shared, often leading to innovation and improvement.

Accommodation

The process of making adjustments or concessions in behavior or beliefs to reconcile differences or alleviate conflict in social or interpersonal contexts.

Collaboration

Working jointly with others, especially in an intellectual endeavor, to achieve a common goal through the sharing of knowledge, learning, and building consensus.

Anxiety

A feeling of worry, nervousness, or unease, typically about an imminent event or something with an uncertain outcome.

Q7: Lilac Corporation incurred $4,700 of legal and

Q15: Nonrefundable credits are those that reduce the

Q25: Don, who is single, sells his personal

Q32: Which of the following statements is correct?<br>A)A

Q37: In 2011, Jenny had a $12,000 net

Q41: Identify how the passive loss rules broadly

Q59: Which of the following satisfy the time

Q64: On December 28, 2012, the board of

Q98: In May 2008, Cindy incurred qualifying rehabilitation

Q105: A business taxpayer sells depreciable business property