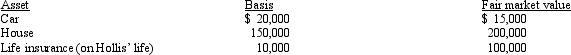

Henrietta and Hollis have been married for 10 years when Hollis dies in a sky-diving accident.Their assets are summarized below.  Henrietta and Hollis reside in Wisconsin, a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Henrietta and Hollis reside in Wisconsin, a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Car House Cash from life insurance proceeds

Definitions:

Assignee

An individual or entity to whom rights or interests have been transferred by another party, known as the assignor.

Agent

An individual authorized to act on behalf of another person or entity, typically in business or legal matters.

Ambiguous Language

Phrases or terms in a document or communication that are unclear or have multiple interpretations, often leading to confusion or misunderstandings.

Assignment

The transfer of rights or property from one party to another.

Q3: The education tax credits (i.e., the American

Q25: Which, if any, of the following taxes

Q26: Stealth taxes have the effect of generating

Q44: What itemized deductions are allowed for both

Q83: Marvin, the vice president of Lavender, Inc.,

Q89: State income taxes generally can be characterized

Q95: During the year, Purple Corporation (a U.S.Corporation)

Q142: On January 18, 2011, Martha purchased 200

Q158: Scott files his tax return 65 days

Q197: The basis of personal use property converted