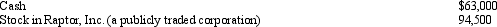

During 2012, Ralph made the following contributions to the University of Oregon (a qualified charitable organization) :  Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000. Ralph's AGI for 2012 is $189,000. What is Ralph's charitable contribution deduction for 2012?

Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000. Ralph's AGI for 2012 is $189,000. What is Ralph's charitable contribution deduction for 2012?

Definitions:

Unsolicited E-Mail

Email that is sent without the recipient's prior consent or request, often considered spam.

Viral Marketing

A marketing technique that uses social networks to promote a product, typically encouraging individuals to share information and content about the product with others.

Sweepstakes

A promotional strategy that involves giving away prizes to randomly selected participants, often used to attract attention or gather consumer data.

Viral Marketing

A marketing technique that uses social networks to increase brand awareness or achieve other marketing objectives through a self-replicating viral process, akin to the spread of viruses.

Q10: In January 2013, Pam, a calendar year

Q17: What is a kickback scheme, and how

Q23: In cases of doubt, courts have held

Q29: The _ Rule makes an opinion admissible

Q35: What three attributes must the plaintiff demonstrate

Q36: Generally, in order to pursue a claim

Q38: Skeeter invests in vacant land for the

Q40: Brayden files his Federal income tax return

Q40: Pedro borrowed $125,000 to purchase a machine

Q45: Virginia had AGI of $100,000 in 2012.