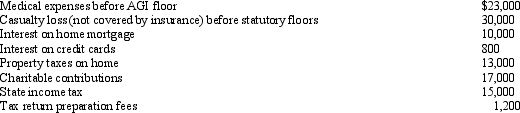

For calendar year 2012, Jon and Betty Hansen file a joint return reflecting AGI of $280,000.They incur the following expenditures:

What is the amount of itemized deductions the Hansens may claim?

What is the amount of itemized deductions the Hansens may claim?

Definitions:

Osteochondral Progenitor Cell

A type of stem cell that has the potential to differentiate into osteoblasts and chondrocytes, contributing to bone and cartilage repair.

Osteoblast

A cell that secretes the matrix for bone formation, involved in the synthesis and mineralization of bone.

Osteocyte

A mature bone cell, embedded within bone matrix, responsible for maintaining bone tissue.

Osteoclast

Osteoclasts are specialized bone cells responsible for the resorption of bone tissue during growth and healing processes.

Q7: What is meant by inventory "shrinkage"?

Q27: If a check is made payable to

Q32: Generally accepted accounting principles require that assets

Q34: In 2012, Pearl invests $80,000 for a

Q47: Alicia buys a beach house for $425,000

Q62: A lack of compliance in the payment

Q97: Before the Sixteenth Amendment to the Constitution

Q130: Taylor inherited 100 acres of land on

Q153: Property can be transferred within the family

Q159: For state income tax purposes, a majority