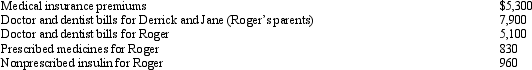

Roger is employed as an actuary.For calendar year 2012, he had AGI of $130,000 and paid the following medical expenses:  Derrick and Jane would qualify as Roger's dependents except that they file a joint return.Roger's medical insurance policy does not cover them.Roger filed a claim for $4,800 of his own expenses with his insurance company in November 2012 and received the reimbursement in January 2013.What is Roger's maximum allowable medical expense deduction for 2012?

Derrick and Jane would qualify as Roger's dependents except that they file a joint return.Roger's medical insurance policy does not cover them.Roger filed a claim for $4,800 of his own expenses with his insurance company in November 2012 and received the reimbursement in January 2013.What is Roger's maximum allowable medical expense deduction for 2012?

Definitions:

Projective Assessments

Psychological tests that use ambiguous stimuli to elicit responses that are thought to reveal a person's unconscious thoughts, feelings, and desires.

Stimuli

External factors or events that provoke a response or reaction from an organism or system.

Sentence Completion Task

A psychological assessment tool where individuals complete sentences in order to reveal their attitudes, thoughts, and feelings.

Verbal Association

The process by which individuals link words together based on their meanings, often studied in psychology and linguistics.

Q4: What are the different types of corruption

Q14: This is an unusual paragraph. I'm curious

Q17: Which of the following is a red

Q32: In this scheme, an employee started his

Q66: The states that impose a general sales

Q74: Discuss the treatment of realized gains from

Q79: Which, if any, of the following correctly

Q79: Last year, Ted invested $100,000 for a

Q89: The maximum amount of the § 121

Q135: If the tax deficiency is attributable to