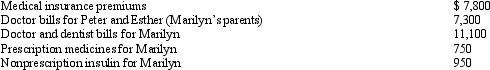

Marilyn is employed as an architect.For calendar year 2012, she had AGI of $204,000 and paid the following medical expenses:

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return. Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2012 and received the reimbursement in January 2013.What is Marilyn's maximum allowable medical expense deduction for 2012?

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return. Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2012 and received the reimbursement in January 2013.What is Marilyn's maximum allowable medical expense deduction for 2012?

Definitions:

Excise Tax

A tax levied on specific goods, services, or activities, such as gasoline, cigarettes, or alcohol, often to discourage consumption or generate revenue.

Recreational Fishing Boats

Boats specifically designed and utilized for the purpose of fishing for leisure or sport, not commercial fishing.

Supply Curve

A graphical representation showing the relationship between the price of a good and the quantity supplied.

Techniques

Methods or approaches used in a particular discipline or activity to achieve a specific result.

Q18: Risk and return are inversely related.

Q20: The threat of _, especially in businesses

Q45: If a misstatement on financial statements is

Q53: Alex has three passive activities with at-risk

Q87: Tom participates for 300 hours in Activity

Q89: State income taxes generally can be characterized

Q114: Jena owns land as an investor.She exchanges

Q132: During any month in which both the

Q142: Cassie purchases a sole proprietorship for $145,000.The

Q142: No state has offered an income tax