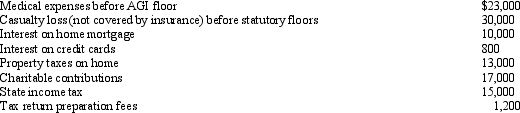

For calendar year 2012, Jon and Betty Hansen file a joint return reflecting AGI of $280,000.They incur the following expenditures:

What is the amount of itemized deductions the Hansens may claim?

What is the amount of itemized deductions the Hansens may claim?

Definitions:

Economic Rent

Extra income generated because of ownership of a scarce resource or possession of a unique skill or capability.

Zero Price Elasticity

A situation where the demand for a good or service remains unchanged regardless of changes in its price.

Equilibrium Economic Rent

The excess returns to a factor of production over its opportunity cost when the market is in equilibrium, ensuring no incentive for resources to move.

Nationalization

The process by which a government takes control of a company or industry, often turning it from private to state ownership.

Q5: Which of the following statements is correct

Q21: How can financial statement fraud be deterred?

Q40: Amber is in the process this year

Q41: If boot is received in a §

Q52: Practicing professionals, because of the nature of

Q69: Which of the following types of exchanges

Q76: The IRS is required to redetermine the

Q105: Interest paid or accrued during the tax

Q129: Pam, a widow, makes cash gifts to

Q180: Betty owns a horse farm with 500