Felice Lucas has just won the state lottery and has the following three payout options for after-tax prize money:

1) $170,000 per year at the end of each of the next six years

2) $312,000 (lump sum) now

3) $508,000 (lump sum) six years from now

The annual discount rate is 9%.Compute the present value of the first option.(Round your answer to the nearest whole dollar. )

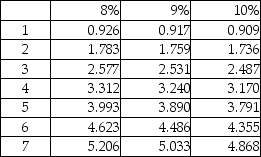

Present value of an ordinary annuity of $1:

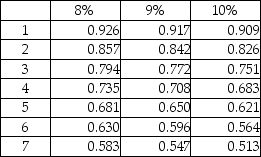

Present value of $1:

Definitions:

Uncollectible

Refers to accounts receivable that a business deems unlikely to be collected and writes off as a loss.

Direct Write-off

A method for accounting for bad debts whereby debts deemed uncollectable are written off directly against income at the time they are determined to be uncollectable.

Allowance Method

An accounting technique used to estimate and account for doubtful accounts, reducing accounts receivable to their net realizable value.

Direct Write-off Method

A method used in accounting to write off bad debt expenses when a company decides an account is uncollectible, directly affecting the income statement.

Q2: Titan Metalworks produces a special kind of

Q8: Arrendo,Inc.is evaluating two possible investments in depreciable

Q21: When using financial performance measures,which of the

Q25: Which capital budgeting method uses accrual accounting,rather

Q32: Investment center managers are responsible for generating

Q50: Which of the following is an example

Q56: Transformation Motor Company produces a part that

Q96: An outsourcing decision is a choice made

Q135: The static budget,at the beginning of the

Q139: The manager of which of the following