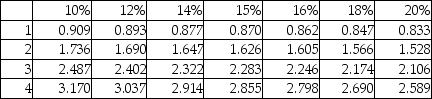

A company is considering an iron ore extraction project that requires an initial investment of $1,400,000 and will yield annual cash inflows of $613,228 for three years.The company's discount rate is 9%.Calculate IRR.

Present value of ordinary annuity of $1:

Definitions:

Millionaires

Individuals whose net worth or wealth is equal to or exceeds one million units of currency.

Life Savings

The total amount of money that an individual has saved over their lifetime, often used in the context of retirement or emergency funds.

Happiness

A state of well-being and contentment; the feeling of positive emotions.

Midlife Working Years

A stage in adult development typically characterized by employment and productivity, often occurring between the ages of 40 and 65.

Q7: Generally, evidence is admissible in court if

Q12: Cressey called embezzlers "temptation violators."

Q27: PCAOB Auditing Standard No. 3 AS3, Audit

Q31: Similarities between organized crime and terrorist organizations

Q37: Collusion requires more than one person to

Q41: Describe occupational fraud and abuse.

Q47: Discourse Stationery Company is a price-taker and

Q57: GrowHealthy,a manufacturer of vegetarian food options,had the

Q165: The level of employee satisfaction is a

Q216: A company is analyzing its month-end results