Moonbeam Company is considering purchasing a new machine for $80,000.The new facility will generate annual net cash inflows of $20,000 for six years.At the end of the six years the machine will have no residual value.The company uses straight-line depreciation,and its stockholders demand an annual return of 12% on investments of this nature.

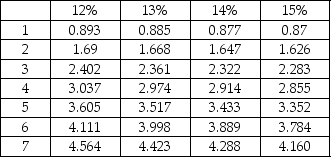

Present value of an ordinary annuity of $1:

Requirements

1.Compute the payback,the ARR,the NPV,the IRR,and the profitability index of this investment.

2.Recommend whether the company should invest in this project.

Definitions:

Monopolistically Competitive

A business environment defined by numerous companies offering products that are alike but not exactly the same, providing them with a certain level of influence over the market.

Pure Monopolist

A market scenario where a single firm is the sole provider of a product or service, without any close substitutes, giving the firm significant market power to influence prices.

Elastic

Describes a situation in which the demand for a product is sensitive to price changes.

Excess Capacity

Plant resources that are underused when imperfectly competitive firms produce less output than that associated with achieving minimum average total cost.

Q16: As a result of events such as

Q35: Allen Boating Company manufactures special metallic materials

Q37: You have just won the lottery and

Q55: A person is said to act in

Q70: Which of the following is NOT part

Q74: A company is considering an iron ore

Q98: A division of a manufacturing company responsible

Q130: The balanced scorecard system requires management to

Q209: In a standard costing system,each input of

Q216: A company is analyzing its month-end results