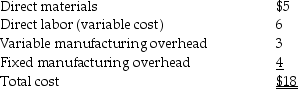

Transformation Motor Company produces a part that is used in the manufacture of one of its products.The unit manufacturing costs of this part,assuming a production level of 6,000 units,are as follows:

Alba Motors Company has offered to sell 6,000 units of the same part to Transformation for $17.50 per unit.Assuming the company has no other use for its facilities and that the fixed manufacturing costs are unavoidable,what should Transformation do?

Definitions:

After-Tax Discount Rate

The rate used to discount future cash flows to their present value after accounting for taxes.

Depreciation Tax Shield

A reduction in taxable income resulting from the allowance for depreciation expenses on assets.

Net Advantage

The benefit or advantage one entity has over competitive entities, often assessed in terms of efficiency, cost, or market position.

Q12: The purchasing manager was able to bring

Q51: Misbah Corporation manufactures two styles of lamps-a

Q54: Supersonic Tire Company makes a special kind

Q72: Sirius,Inc.has average total assets of $300,000.The annual

Q88: Which of the following is an advantage

Q123: A company produces 1000 packages of chicken

Q123: Which of the following best describes a

Q177: A favorable sales volume variance in sales

Q182: Which of the following is a NOT

Q223: Based on the following,what is the total