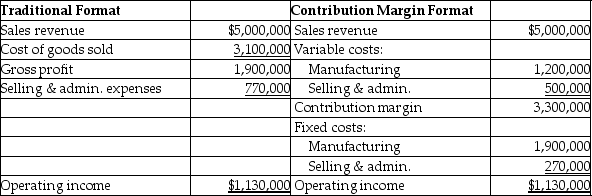

Mobile Concepts makes special equipment used in cell towers.Each unit sells for $400.Mobile Concepts uses just-in-time inventory procedures;it produces and sells 12,500 units per year.It has provided the following income statement data:

A foreign company has offered to buy 100 units for a reduced sales price of $250 per unit.The marketing manager says the sale will have no negative impact on the company's regular sales.The sales manager says that this sale will not require any variable selling and administrative costs.The production manager reports that there is plenty of excess capacity to accommodate the deal without requiring any additional fixed costs.If Mobile Concepts accepts the deal,how will this impact operating income? (Round any intermediate calculations to the nearest cent,and your final answer to the nearest dollar. )

Definitions:

Motivational Benefits

Rewards or incentives that enhance an employee's drive and willingness to perform their duties effectively and efficiently.

Enactive Mastery

Gaining confidence or expertise in a particular area through hands-on experience and practical engagement.

Self-Efficacy

A belief in one's own ability to complete tasks and reach goals.

Confident

The feeling or belief that one can rely on someone or something; firm trust and self-assurance.

Q4: Off shore banks: <br>A) Are illegal to

Q6: The flexible budget variance is the difference

Q25: Residual income is used as a key

Q43: Which of the following internal business perspective

Q67: List two objectives in setting transfer prices.

Q112: Sayer Tool Co.is considering investing in specialized

Q122: Capital budgeting involves _.<br>A)budgeting for yearly operational

Q130: The discount rate used in a net

Q190: Allen's Ark sells 2000 canoes per year

Q221: Based on the following,what is the total