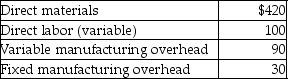

Carver Company manufactures a component used in the production of one of its main products.The following cost information is available:

A supplier has offered to sell the component to Carver for $650 per unit.If Carver buys the component from the supplier,the released facilities can be used to manufacture a product that would generate a contribution margin of $10,000 annually.Assuming that Carver needs 3000 components annually and that the fixed manufacturing overhead is unavoidable,what would be the impact on operating income if Carver outsources?

Definitions:

Bond Stripping

Selling bond cash flows (either coupon or principal payments) as stand-alone zero-coupon securities.

Arbitrage

The method of earning profits by exploiting the price variances of an identical asset across diverse markets through concurrent purchase and sale.

Law of One Price

The economic theory that states that the price of an identical asset or commodity will have the same price globally when price differences account for exchange rates.

Yield to Maturity

The total return anticipated on a bond if the bond is held until it matures, incorporating both interest payments received and any gain or loss if the bond is bought at a discount or premium to its face value.

Q29: Capital budgeting methods which incorporate the time

Q38: Net present value represents the difference between

Q40: Efficiency variance<br>A)the difference between actual results and

Q65: Revenue center responsibility reports show all costs

Q91: The flexible budget variance is the difference

Q104: The payback method is used only when

Q121: Which of the following statements is true

Q149: When a division is operating at capacity,the

Q178: When recording direct materials usage,what does an

Q190: Global Engineering's actual operating income for the