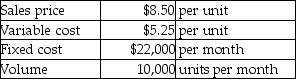

A small business produces a single product and reports the following data:

The company believes that the volume will go up to 12,000 units if the company reduces its sales price to $7.50.How would this change affect operating income?

Definitions:

Standard Variable Overhead Rate

The predetermined rate at which variable overhead costs are expected to occur relative to a specific activity or cost driver.

Variable Manufacturing Overhead

The portion of manufacturing overhead costs that varies with production volume.

Variable Overhead Efficiency Variance

Variable overhead efficiency variance is the difference between the actual and budgeted variable overhead cost based on the efficient utilization of resources.

Direct Labor-hours

The amount of labor hours that can be directly attributed to the production process, serving as a basis for allocating manufacturing overhead costs in some costing systems.

Q36: Under the just-in-time costing system,underallocated and overallocated

Q56: A small business produces a single product

Q79: In the variable costing income statement,variable costs

Q104: The production cost reports show the calculations

Q116: Fixed costs per unit decrease as production

Q126: Nelson Manufacturing has two processing departments,Department I

Q157: Flannery Company,a manufacturer of small appliances,had the

Q158: An increase in contribution margin per unit

Q171: Martin was a professional classical guitar player

Q199: Andrea,a production manager for Akim Manufacturing,is investigating