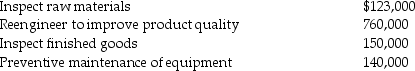

A company is considering spending the following on a new quality improvement program:

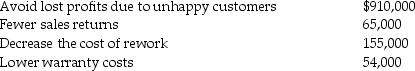

The company expects this quality program to reduce costs by the following amounts:

Group each cost under the four categories of quality management systems.Comment whether the company should undertake the quality improvement program.

Definitions:

Wage-Base Limitation

A wage-base limitation refers to the maximum amount of earnings that is taxed for certain social services, such as Social Security, beyond which earnings are no longer subject to the tax.

Regressive

A term typically used to describe a tax system where the tax rate decreases as the taxable amount increases, placing a heavier burden on lower-income individuals.

Wages and Salary

Compensation received by employees for their labor, typically paid as hourly wages or annual salaries.

Taxed

Taxed refers to the imposition of financial charges or other levies upon a taxpayer by a governmental organization in order to fund government spending and various public expenditures.

Q3: Mirabella Company assigns direct materials,direct labor and

Q12: Venus Manufacturing uses a predetermined overhead allocation

Q33: The margin of safety can be used

Q48: Under a process costing system,product costs are

Q58: A modification of the overhead allocation method

Q64: The Refining Department of SweetBeet,Inc.had 79,000 tons

Q67: The weighted-average method determines the cost of

Q72: Unlike manufacturing companies,service companies use an allocation

Q155: Gitli Company sells its product for $60

Q187: Leonardo was a professional classical guitarist until