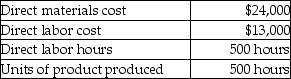

Olympia Manufacturing uses a predetermined overhead allocation rate based on direct labor cost.At the beginning of the year,Olympia estimated total manufacturing overhead costs at $1,010,000 and total direct labor costs at $820,000.In June,Job 511 was completed.The details of Job 511 are shown below.

What is the amount of manufacturing overhead costs allocated to Job 511? (Round any percentages to two decimal places and your final answer to the nearest dollar. )

Definitions:

Operating Contribution

The portion of revenue that remains after variable expenses are subtracted, indicating how much contributes to covering fixed costs and generating profit.

Restricted Contribution

Funds given to an organization with specific conditions attached regarding their use.

Donation Revenue

Income received from giving without the expectation of receiving something in return, typically for non-profit organizations.

Restricted Fund Method

An accounting strategy used for tracking and reporting separately on resources that are restricted by donors for specific purposes.

Q10: Because Activity-Based Costing considers the resources each

Q20: Enzo Design Corporation reports the following cost

Q67: The weighted-average method determines the cost of

Q105: The financial statements for Barrington Service Company

Q132: The Doughboys Pizza Company sells pizzas in

Q136: Production cost reports prepared using the first-in,first-out

Q141: Gizmo Company,a manufacturer of small appliances,had the

Q154: The Work-in-Process Inventory account of a department

Q155: Which of the following functions might be

Q178: The just-in-time management system results in an