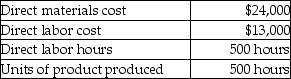

Olympia Manufacturing uses a predetermined overhead allocation rate based on direct labor cost.At the beginning of the year,Olympia estimated total manufacturing overhead costs at $1,010,000 and total direct labor costs at $820,000.In June,Job 511 was completed.The details of Job 511 are shown below.

What is the amount of manufacturing overhead costs allocated to Job 511? (Round any percentages to two decimal places and your final answer to the nearest dollar. )

Definitions:

Product Line

A group of related products produced by a business, often sharing common attributes, marketing channels, or uses.

Financial Statements

Documents that present an organization's financial activity and condition, including income statement, balance sheet, and cash flow statement.

Income Statement

A financial statement showing the company's revenues and expenses over a specific period, resulting in net profit or loss.

Balance Sheet

A financial statement that provides a snapshot at a certain date, representing a company's assets, liabilities, and shareholders' equity.

Q34: The direct labor costs and manufacturing overhead

Q42: The journal entry to record allocation of

Q47: The predetermined overhead rate is calculated _.<br>A)after

Q52: In a manufacturing plant,indirect materials costs from

Q92: A process costing system is most suitable

Q110: A modification of the overhead allocation method

Q121: Define indirect labor and give two examples

Q132: Under a process costing system,costs of completed

Q165: On June 30,Caroline,Inc.finished Job 750 with total

Q186: The just-in-time costing system waits until the