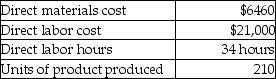

Jordan Manufacturing uses a predetermined overhead allocation rate based on direct labor cost.At the beginning of the year,it estimated the manufacturing overhead rate to be 20% times the direct labor cost.In the month of June,Jordan completed Job 13C,and its details are as follows:

What is the cost per unit of finished product of Job 13C? (Round your answer to the nearest cent. )

Definitions:

Personal Mandate Provision

A legislative requirement that individuals obtain or provide themselves with a specific service or product.

Federal Poverty Line

A government-determined income threshold below which an individual or family is considered to be living in poverty.

Health Insurance Subsidies

Financial assistance provided by the government or other institutions to help individuals or families afford health insurance premiums.

Personal Wellness Accounts

Financial accounts dedicated to funding personal health and wellness expenses, potentially including fitness memberships, nutritional supplements, and mental health services.

Q41: Bag Ladies,Inc.manufactures two kinds of bags-totes and

Q44: Activity-based costing allows managers to evaluate overall

Q52: In a manufacturing plant,indirect materials costs from

Q78: Ratio analysis is used most effectively to

Q102: Midtown,Inc.uses a predetermined overhead allocation rate of

Q115: Managers can use activity-based management to make

Q129: Goods that are produced by a manufacturing

Q145: Allen Manufacturing has three departments that differ

Q169: A company that sells multiple products will

Q187: List and briefly discuss three major differences