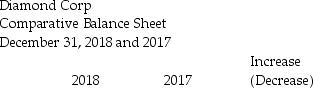

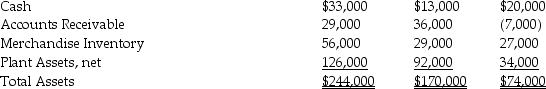

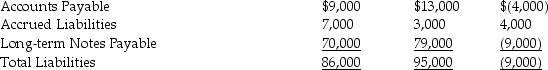

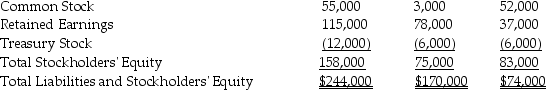

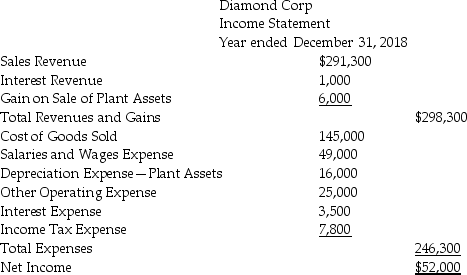

Diamond Corp.has provided the following information for the year ended December 31,2018.

Additional information provided by the company includes the following:

Equipment costing $60,000 was purchased for cash.

Equipment with a net book value of $10,000 was sold for $16,000.

Depreciation expense of $16,000 was recorded during the year.

During 2018,the company repaid $43,000 of long-term notes payable.

During 2018,the company borrowed $34,000 on a new long-term note payable.

There were no stock retirements during the year.

There were no sales of treasury stock during the year.

All sales are on credit.

Prepare the 2018 statement of cash flows,using the indirect method.

Definitions:

Charged Polygamy

The legal accusation against an individual or individuals for being married to more than one person at the same time, which is illegal in most countries.

Mormon Church

Officially known as The Church of Jesus Christ of Latter-day Saints, a religious organization founded in the 19th century in the United States, emphasizing restorationist Christianity.

Legitimate Sons

Historically, refers to sons born within a lawful marriage who were legally entitled to inherit property and titles from their fathers, contrasting with illegitimate or extramarital offspring.

Friedrich Engels

A German philosopher, social scientist, and journalist who co-developed Marxist theory with Karl Marx.

Q1: The direct method starts with net income

Q19: Which of the following is true of

Q48: The net income of a company for

Q61: The issuance of a note is recorded,on

Q95: The formula for calculating the cash ratio

Q109: On July 1,2018,Mason & Beech Services issued

Q117: When stock is issued for assets other

Q142: The gross profit percentage is an indicator

Q159: The statement of cash flows is the

Q199: For a manufacturer,rent paid for an office