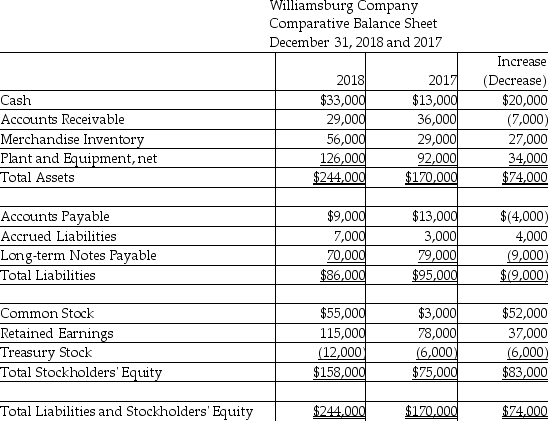

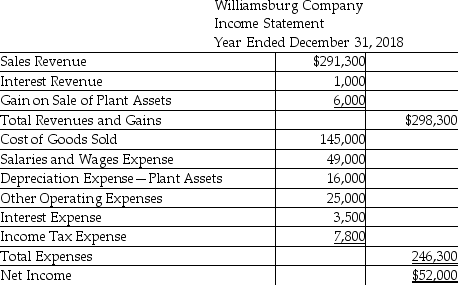

Williamsburg Company uses the direct method to prepare its statement of cash flows.Refer to the following financial statement information for the year ending December 31,2018:

Additional information provided by the company includes the following:

Equipment costing $60,000 was purchased for cash.

Equipment with a net asset value of $10,000 was sold for $16,000.

During 2018,the company repaid $43,000 of long-term notes payable.

During 2018,the company borrowed $34,000 on a new note payable.

There were no stock retirements during the year.

There were no sales of Treasury Stock during the year.

Prepare a complete statement of cash flows using the direct method.

Accrued Liabilities relate to other operating expenses.

Definitions:

Macaulay Duration

A measure of the weighted average time until a bond or fixed income portfolio's cash flows are received, used to gauge interest rate sensitivity.

Yield

The income returned on an investment, such as the interest or dividends received, typically expressed as a percentage of the investment’s cost or current market value.

Modified Duration

Modified Duration measures the sensitivity of the price of a bond or other debt instrument to a change in interest rates, indicating the percentage change in price for a parallel shift in rates.

Modified Duration

A measure of the sensitivity of a bond's or bond portfolio's price to changes in interest rates, adjusting for the changing yield to maturity.

Q1: Which of the following statements is true?<br>A)Appropriations

Q26: Normally,companies with low gross profit percentages will

Q48: Manley Corporation issued 2,500 shares of its

Q62: The balance sheet of a _ company

Q65: When computing the present value of a

Q107: Generally accepted accounting principles require that interest

Q159: The statement of cash flows is the

Q185: Rosiland,Inc.purchases 16,000 shares of its previously issued

Q201: When computing a bond's cash flow for

Q259: The 2019 balance sheet for Standard Electronics