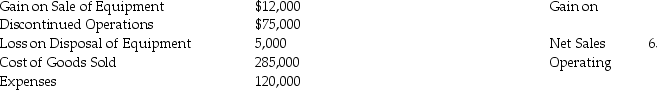

Adams Corporation's accounting records include the following items for the year ending December 31,2019:

The income tax rate for the company is 25%.Prepare Adams' multi-step income statement for the year ended December 31,2019.Omit earnings per share.

Definitions:

Courts of Appeals

Intermediate appellate courts in the United States federal court system that review and decide appeals from federal district courts and administrative agencies.

Reporters

Individuals, often journalists, who investigate and report news stories to the public through various media channels.

Courts of Equity

Judicial venues that decide cases based on fairness and moral righteousness, as opposed to strictly adhering to written laws.

Separate Court Systems

Jurisdictional distinctions within a country's judiciary, where different types of courts handle specific kinds of matters, such as federal versus state courts in the United States.

Q21: The following information is from the December

Q83: The price/earnings ratio measures the value that

Q96: Gains and losses on the sale of

Q97: Identify how each of the following items

Q127: The issuance of common stock for cash

Q137: On March 1,2018,Lewis Services issued a 6%

Q152: Special items and earnings per share are

Q159: The statement of cash flows is the

Q175: When preparing the statement of cash flows

Q240: Preferred stock is stock _.<br>A)that sells for